The post-bankruptcy future of PG&E will perhaps be the largest piece of unresolved work facing California heading into a new decade.

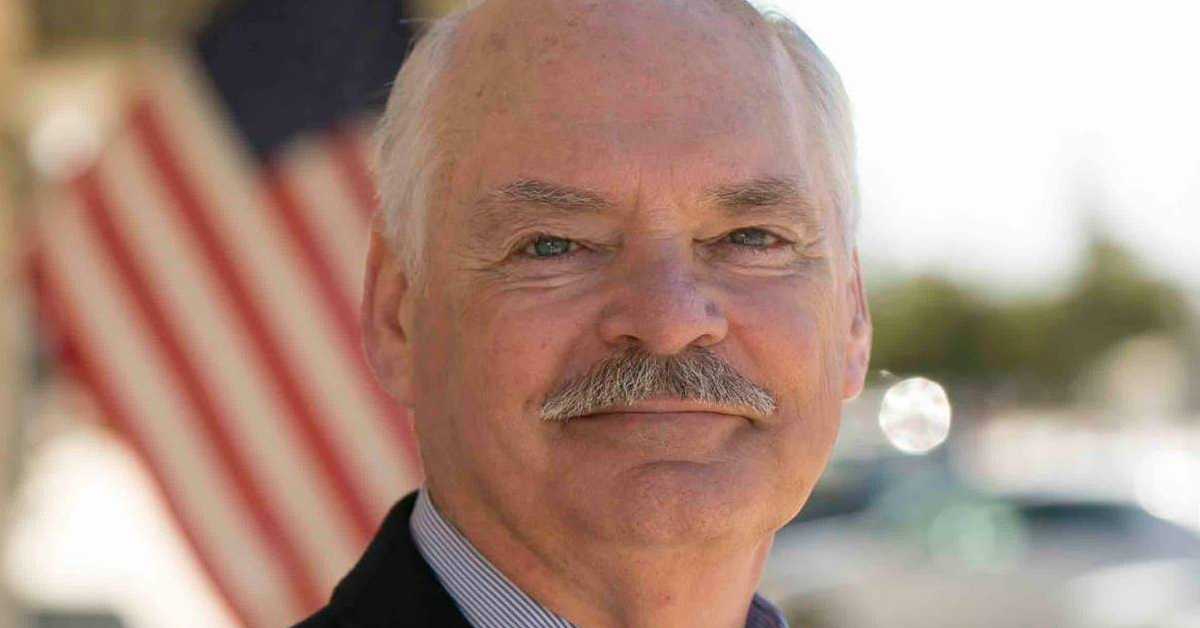

While bankruptcy proceedings continue, a push by San Jose Mayor Sam Liccardo to drive it forward appears to be just the start.

Last month, Liccardo pitched local leaders across PG&E’s service area – spanning from the California-Oregon Border to Bakersfield and running along the Central coastline – on a proposal wherein the state’s electricity regulator would allow ratepayers to buy out the company.

From there, PG&E would be a publicly-owned co-operative energy provider.

Tuesday, the Kern County Board of Supervisors will vote to decide whether to send a letter to Gov. Gavin Newsom endorsing – among other options – Liccardo’s plan.

“Kern County is prepared to explore, while engaging our county and city counterparts in the San Joaquin Valley options to ensure a reliable energy service for our community and simple economic survival for our busineses through options such as: the creation of publicly owned utility, or as suggested by San Jose Mayor Sam Liccardi (sic) in his letter to the CPUC, a customer-owned utility or cooperative,” the proposed letter reads.

“At the very least we ask that your administration champion an effort to reorganize PG&E into regional business units for rate-setting purposes that would provide greater equity for our residents,” it continues.

The initial push from Liccardo was endorsed by a wide swath of Bay Area Mayors and County Supervisors. The lone initial supporters in the Central Valley were Sacramento Mayor Darrell Steinberg and Stockton Mayor Michael Tubbs.

After Liccardo’s campaign went public in early November, Clovis Mayor Drew Bessinger announced his support for the idea – but conditioned it on the fact that his endorsement did not indicate that of the City of Clovis.

Meanwhile, Fresno Mayor Lee Brand has not committed support to the plan and is still evaluating the proposal, he said through a spokesman.

In November, PG&E said it would not consider Liccardo’s plan.

“We are aware of proposals by various government agencies to acquire PG&E assets or to convert parts of the company to what is being described as a mutualized entity,” PG&E said via statement in November. “We study and analyze each proposal. However, PG&E’s facilities are not for sale, and changing the structure of the company would not create a safer operation.”

The utility also scored a major landmark in its bankruptcy proceedings, settling with victims of the 2018 Camp Fire for $13.5 billion.

The settlement removes a major obstacle as the utility looks to have its planned bankruptcy emergence plan chosen over those proposed by its top creditors – investment firms PIMCO and Elliott Management Corp.