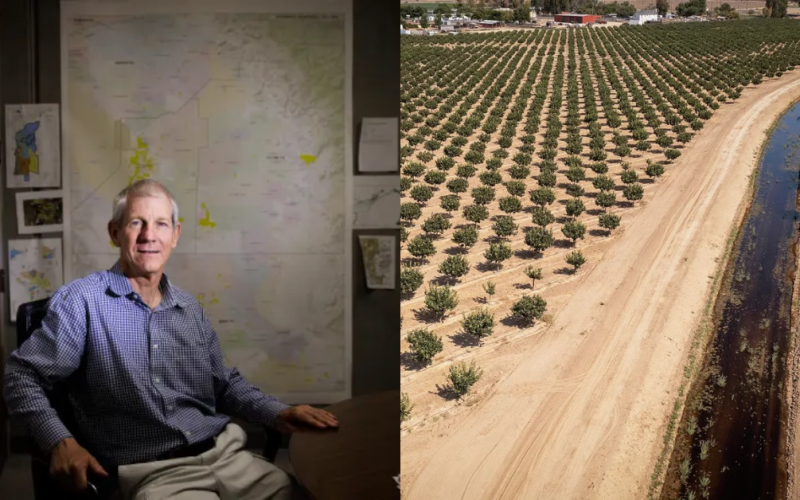

John Vidovich, the Bay Area-based water magnate of the southern San Joaquin Valley, is being sued for failing to repay roughly $105 million in loans to U.S. Bank.

U.S. Bank filed a lawsuit against Vidovich and his companies, Sandridge Partners and SunnyGem LLC, in Kern County Superior Court with a demand for seizure of property. The news was first reported by SJV Water.

The big picture: Along with Vidovich, U.S. Bank named Sandridge Partners, SunnyGem, The Apricot Pit L.P.and several members of Vidovich’s family.

- U.S. Bank claims Sandridge Partners had not paid back $67.7 million of debt that went into default in December.

- The bank also claims that SunnyGem still owed $37.5 million in loans and lines of credits that went into default in May 2024.

Driving the news: The lawsuit details several loans made to Sandridge Partners and SunnyGem over the last several years.

- Sandridge Partners grows almonds and operates a raw processing huller-sheller facility, while SunnyGem processes the almonds and operates a processing plant in Wasco.

- Vidovich owns over 100,000 acres across Fresno, Kings, Tulare and Kern counties, with the majority of it in Kings County.

Zoom in: The lawsuit alleges that Vidovich took out around $110 million in several loans and lines of credit for Sandridge Partners and SunnyGem, with around $105 million outstanding last year.

- As detailed in the lawsuit, the Sandridge loan balances earlier this month were $7 million for a solar loan, $9.4 million for an eastside properties loan, $22.2 million for a 2019 revolving loan, $18.4 million for a collateral pool loan and $4.2 million for huller-sheller loans.

- SunnyGem had a $60 million revolving line of credit initially that was reduced to $14.8 million non-revolving line of credit. Vidovich and his family also guaranteed a $22.5 million loan for SunnyGem that was ultimately not paid back.

What we’re watching: U.S. Bank is asking the court to appoint a receiver to take possession of the property in question.

- A case management conference has been scheduled for Sep. 8.

The big picture: Vidovich’s current issues are the latest in a line of major farming outfits in the San Joaquin Valley facing a financial beating over the past two years.

- Stone fruit giant Prima Wawona filed for bankruptcy in October 2023 after transitioning from local ownership to private equity management.

- Fellow private equity-owned almond farming enterprise, Trinitas Farming LLC, filed for bankruptcy. The large-scale almond grower posted $188 million in debt upon its filing.

- In late 2024, Fresno’s Assemi family – once the largest growers of California pistachios and a one-time major supplier to the Wonderful Pistachios co-operative – began shopping its entire portfolio of farm properties, which included processing plants for its Touchstone Pistachios brand, and 52,000 acres of farm land sprawling across the Valley.

- The Fresno farming family defaulted on $700 million in loans issued by Prudential Insurance Company and another $149 million in loans also issued by U.S. Bank.

Read the lawsuit: